Personalized Investment Strategies

Active Portfolio Monitoring

Tax-Efficient Wealth Growth

We help individuals and businesses grow wealth, reduce risk, and achieve long-term success.

Over $500 million successful investment portfolios managed globally.

98% of our clients have reported significant growth in their investments within the first year.

We specialize in providing tailored financial solutions to help both businesses and individuals achieve their investment goals. Our years of experience in wealth management, retirement planning, and portfolio strategy give you the confidence to succeed in any market condition.

Our team of financial experts provides actionable insights and strategies, ensuring your investments are secure and poised for growth.

We offer personalized investment strategies designed to align with your financial goals, whether you are seeking long-term growth or immediate returns.

With a track record of delivering successful outcomes, we’ve earned the trust of our clients by helping them achieve substantial growth and financial independence.

We offer a range of investment and financial services that are designed to meet the needs of individuals and businesses looking to grow and secure their wealth.

Invest in sustainable agricultural projects for steady returns. Our focus on sustainability and growth potential makes this a promising investment avenue.

Invest in the oil market to capitalize on global energy demands. Our market insights and expert analysis make us a reliable partner in this sector.

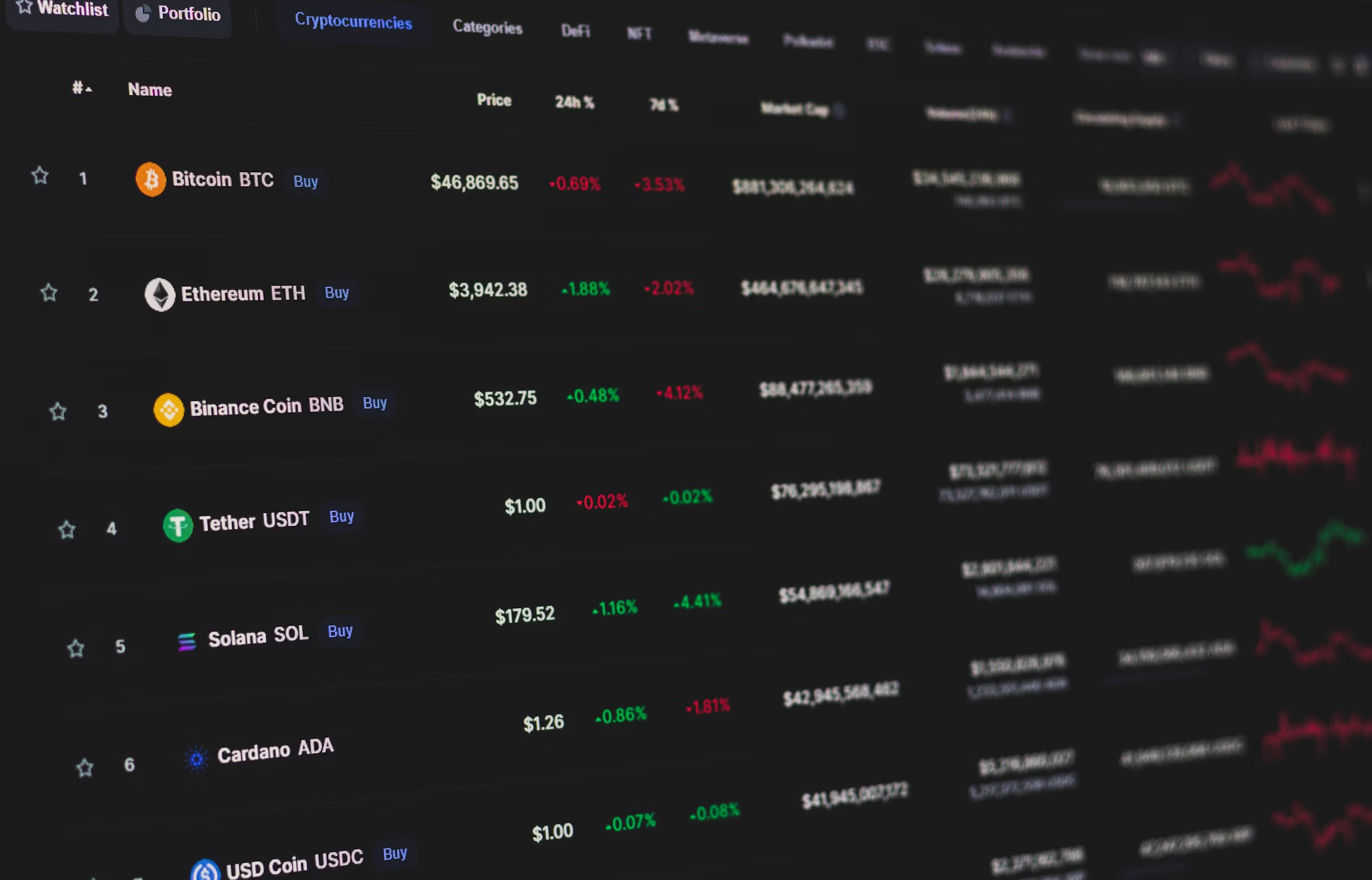

Generate profits through efficient cryptocurrency mining operations. With cutting-edge technology and expert management, we ensure high returns on your investment.

Maximize your returns through strategic cryptocurrency trading. Our high-yield, 24/7 trading services ensure that you stay ahead in the rapidly-evolving crypto market.

Capitalize on currency fluctuations with our expert forex trading services. Our global market insights and expert analysis make us a reliable partner in this dynamic sector.

Diversify your portfolio with strategic futures investments. Our expert insights and risk management strategies help you maximize potential returns while navigating market fluctuations.

Secure your wealth with strategic investments in gold. Our safe haven and value preservation strategies ensure that your investment remains protected and profitable.

Invest in lucrative real estate opportunities for long-term gains. Our services cover property development and asset management, ensuring stable and profitable growth.

Secure a comfortable and financially stable retirement with our expertly crafted investment strategies. Our tailored retirement solutions are designed to help you grow long-term wealth, providing both security and peace of mind as you prepare for your golden years.

Plan for a comfortable and financially secure retirement with our expert-guided stock investment strategies. Our tailored retirement solutions focus on building long-term wealth through strategic stock market investments, ensuring stability and peace of mind for your golden years. Let us help you grow your portfolio and secure your future with confidence.

Our team of seasoned financial experts provides customized investment strategies that maximize returns, mitigate risks, and secure long-term financial success for individuals and institutions alike.

Our tailored portfolio management services are designed to help clients grow their investments strategically, ensuring optimal performance in diverse market conditions.

Personalized Investment Strategies

Active Portfolio Monitoring

Tax-Efficient Wealth Growth

We design customized retirement strategies that ensure financial security, giving you the peace of mind to enjoy your golden years without financial worry.

Comprehensive Retirement Strategies

Social Security Optimization

Longevity Risk Management

We help clients identify, manage, and reduce financial risks through tailored strategies that safeguard their investments against uncertainty and volatility.

Strategic Risk Management

Diversification Strategies

Market Volatility Protection

Our wealth management services provide holistic strategies that preserve and grow your assets, ensuring long-term financial prosperity for future generations.

Estate and Legacy Planning

Investment Strategy Design

Wealth Preservation

Our platform offers tailored investment strategies powered by cutting-edge technology and expert insights. We focus on your financial goals, providing transparency, security, and long-term growth.

We understand that each investor has unique goals. Our approach is centered around personalized strategies, data-driven insights, and consistent monitoring to ensure your investments thrive.

Delve into intriguing insights about the investment world. Discover how trends, statistics, and historical events influence today’s financial landscape, making you a more informed investor.

Begin by quickly signing up and creating an account to access all investment opportunities.

Securely fund your account and explore a wide array of investment options tailored to your goals.

Monitor your investment returns and withdraw profits anytime, anywhere, with ease.

Find your perfect fit at siteSettings('sitename'))?> We offer tailored solutions for investors at every stage. Let us guide you toward success.

$200 - $1999

$10000 - Unlimited

$2000 - $9999

The number of publicly traded companies worldwide.

Percentage of financial advisors who recommend investing early.

To start investing, create an account on our platform, choose an investment plan that suits your goals, and fund your account using one of our accepted payment methods.

We offer various investment plans, including fixed-rate plans, profit-sharing plans, and flexible plans that cater to different risk appetites and investment durations.

Return frequencies depend on the investment plan you select. Some plans offer daily returns, while others provide weekly or monthly payouts.

We implement various security measures to protect your investment, and try our best to minimize risk and loss of funds.

Early withdrawal policies vary by plan. Some plans may allow it, but others may have penalties or restrictions. Please review the terms of your chosen plan for details.

You can track your investment progress through your account dashboard, which provides real-time updates on your earnings, investment status, and transaction history.

We accept various payment methods, including credit/debit cards, cryptocurrencies, and bank transfers. Please check our website for a complete list of accepted methods.

Withdrawal fees depend on the payment method and the amount withdrawn. Please refer to our fee schedule for specific details.

If you have any questions or issues, you can contact our support team via email, live chat, or through our contact form on the website. We’re here to help!

Creating multiple accounts is against our policy. Each investor is allowed only one account to maintain fair play and investment integrity.

Discover effective strategies to enhance your business's financial growth. From smart budgeting to investment tips, this post covers essential insights to help you improve profitability and achieve long-term success.